What is Decentralised Finance (DeFi)?

OnFinality, a multi-chain infrastructure provider, shares how it is helping shape DeFi with scalable API and node services.

OnFinality is a blockchain infrastructure platform that saves web3 builders time and makes their lives easier. We deliver easy-to-use, reliable and scalable API endpoints for the biggest blockchain networks and empower developers to automatically test, deploy, scale and monitor their own blockchain nodes in minutes.

In this article, we dive into one of web3’s hottest sectors — Decentralised Finance (DeFi). We explore how DeFi is challenging conventional norms and whether it could replace the current financial system.

TLDR

- Our global financial system is facing a crisis

- DeFi presents a new model of finance through blockchain technology and cryptocurrencies

- DeFi could return the power of our monetary system into the hands of the people

What does DeFi mean?

Decentralised Finance (also known as DeFi) is a new model of finance, breaking down the barriers of entry for all to have free and open access to financial products and services.

When did DeFi start?

DeFi owes its existence to the launch of the Ethereum blockchain in 2015 and the rise of smart contracts. Some DeFi protocols, such as MakerDAO, were in development as early as 2014. Decentralised exchanges like EtherDelta emerged in 2017 alongside ICOs. (Decrypt)

How does DeFi work?

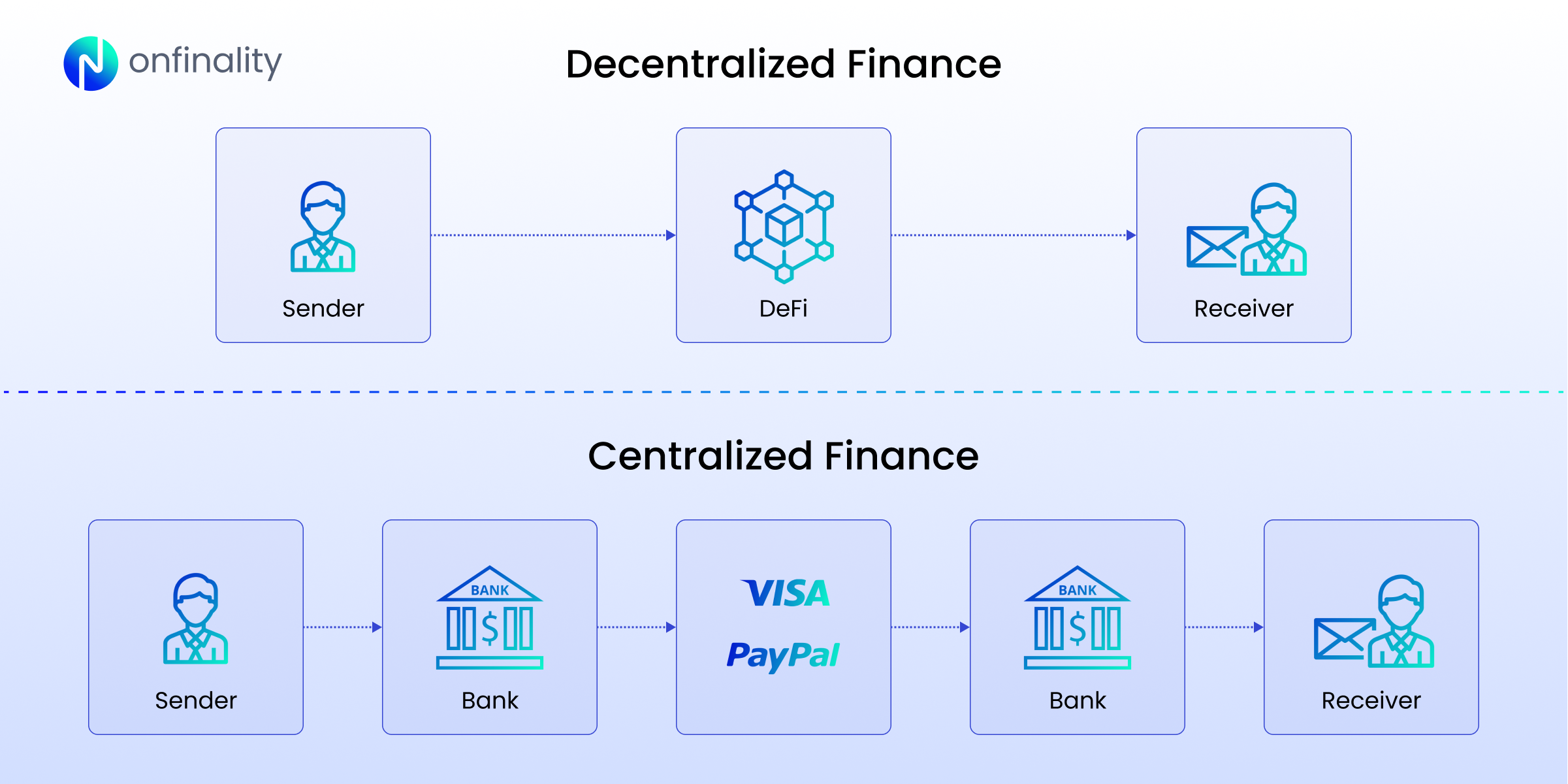

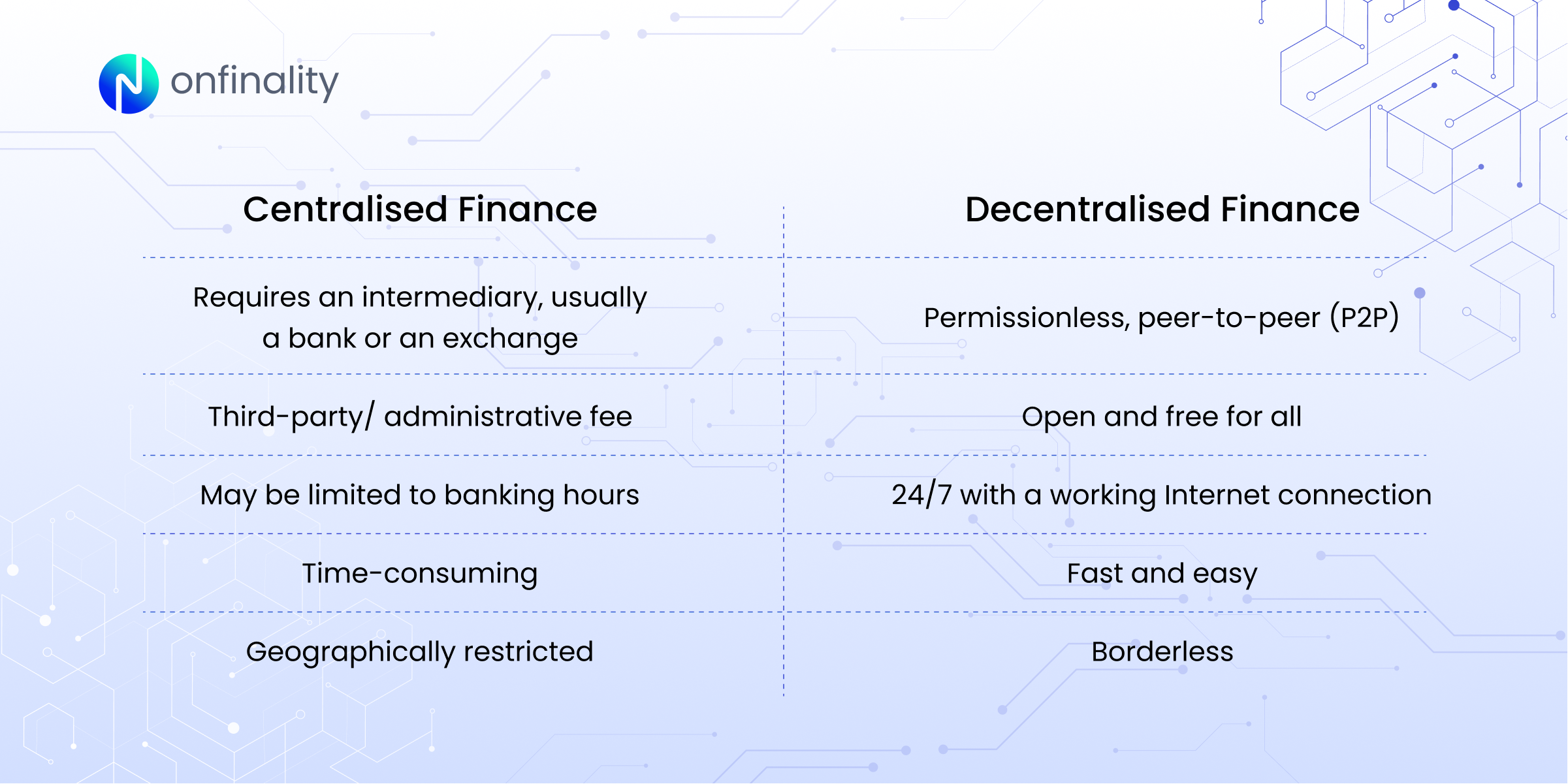

DeFi protocols built on Distributed Ledger Technologies (DLTs) such as blockchain, enable individuals to directly interact with protocols to access financial services, eliminating the need for intermediaries such as banks or brokers.

DApps (Decentralised Applications) that run on the blockchain, serve as the interface for users to interact with these financial services and protocols, enabling users to lend, borrow, trade and participate in financial activities directly from their wallets.

Smart Contracts, particularly on Ethereum, further automate and enforce agreements within the DeFi ecosystem.

At the heart of DeFi’s security is the application of cryptographic techniques, that employ blockchain’s inherent transparency while safeguarding user privacy through pseudonymous addresses.

This added layer of security and discretion enhances the user experience while fostering trust within the decentralised finance ecosystem.

In layman terms:

Anyone with a working Internet connection can now make transactions and payments from anywhere in the world at any time without being limited by geographical location or central authorities.

Gone are the days where we are required to go to the bank and fill out hefty paperwork for huge transactions (such as the purchase of a house or a car), and then wait for days for the transaction to be approved by a governing/ authorised body.

Simply put, you can now enjoy user-friendly financial services without compromising your personal identity or private information!

Real-World DeFi Use Cases

While DeFi may seem like an idealistic or farfetched concept in first world countries, it is already making an impact in countries facing a state of emergency.

For example, women in Afghanistan turning to crypto to feed their families as the economy crumbles under the Taliban.

What is ‘Crypto’ in DeFi?

Cryptocurrencies (crypto) are an alternative form of digital currency designed to work as a medium of exchange through a computer network that is not reliant on any central authority, such as a government or bank, to uphold or maintain it.

Due to the nature of cryptocurrencies being decentralised and ungoverned (by a central body), people can now have full ‘ownership’ over how they access and use their money.

Centralised Finance vs Decentralised Finance

Below, we look at how DeFi promises to deliver cheaper, faster and more efficient transactions as compared to Centralised Finance — the current monetary system as we know it.

What does DeFi really solve?

More than just the added convenience, DeFi goes beyond a pretty user interface and transactions at your fingertips to solve deep seated problems plaguing the existing financial system.

Our financial system is facing a meltdown, not only on a corporate level, but on National levels, and even globe-wide crises. From the Enron Scandal (2001), to the Greek government debt crisis (2009), hyperinflation in Venezuela (2016) and more recently the Collapse of FTX and the bank run on SVB (Silicon Valley Bank).

While FTX represented a gateway into crypto, ultimately, it still operated on a traditional finance model where billions of dollars were left in the hands of a few.

To quote John J. Ray III, the new CEO of FTX (known for his work on the Enron bankruptcy), the fall of FTX was ‘a complete failure of corporate controls’.

This same ‘corporate control’ that had led the people to put their trust and money in the hands of a charismatic leader, was but an illusion of control over their assets.

The fall of FTX only ascertains the need for a trustless system — one not built on charisma and media narratives, susceptible to human temptation and greed; but one governed by consensus mechanisms and immutable ledgers, ensuring unrivalled transparency, 100% accuracy, and full accountability to all stakeholders on the blockchain.

The Current State of DeFi

Today, cryptocurrencies and its broader ecosystem, DeFi, remains a controversial topic. With the underlying technology still going through rigorous tests and development, regulators are scrambling to catch up with bad actors cashing in on the ambiguity of jurisdictions around crypto.

A powerful tool that could help transform the lives of the unbanked in Africa, could on the flipside, be an avenue for sanctions evasion and money laundering through NFTs (non-fungible tokens) and crypto mixers that obscures the connection between the source and the fund.

Just as technology can be used for good, it can also be used for evil; the elimination of the intermediary also risks removing some of the functions these roles traditionally serve, such as identity verification (through KYC), fraud detection, anti-money laundering (AML) and suspicious transaction activity checks.

As the DeFi ecosystem continues to grow, its future remains intertwined with the regulatory landscape and the potential integration of Centralised Finance (CeFi). Balancing innovation with regulation could unlock a hybrid approach, harnessing the benefits of both DeFi and CeFi for a more inclusive and robust financial future.

How OnFinality Supports DeFi projects

OnFinality actively supports the growth and development of DeFi teams by providing essential API and node services.

For example, Polkadex, a fully decentralised peer-to-peer orderbook-based cryptocurrency exchange built on Substrate, leverages OnFinality’s one-click node solution to simplify the deployment of validators and enhance community inclusiveness.

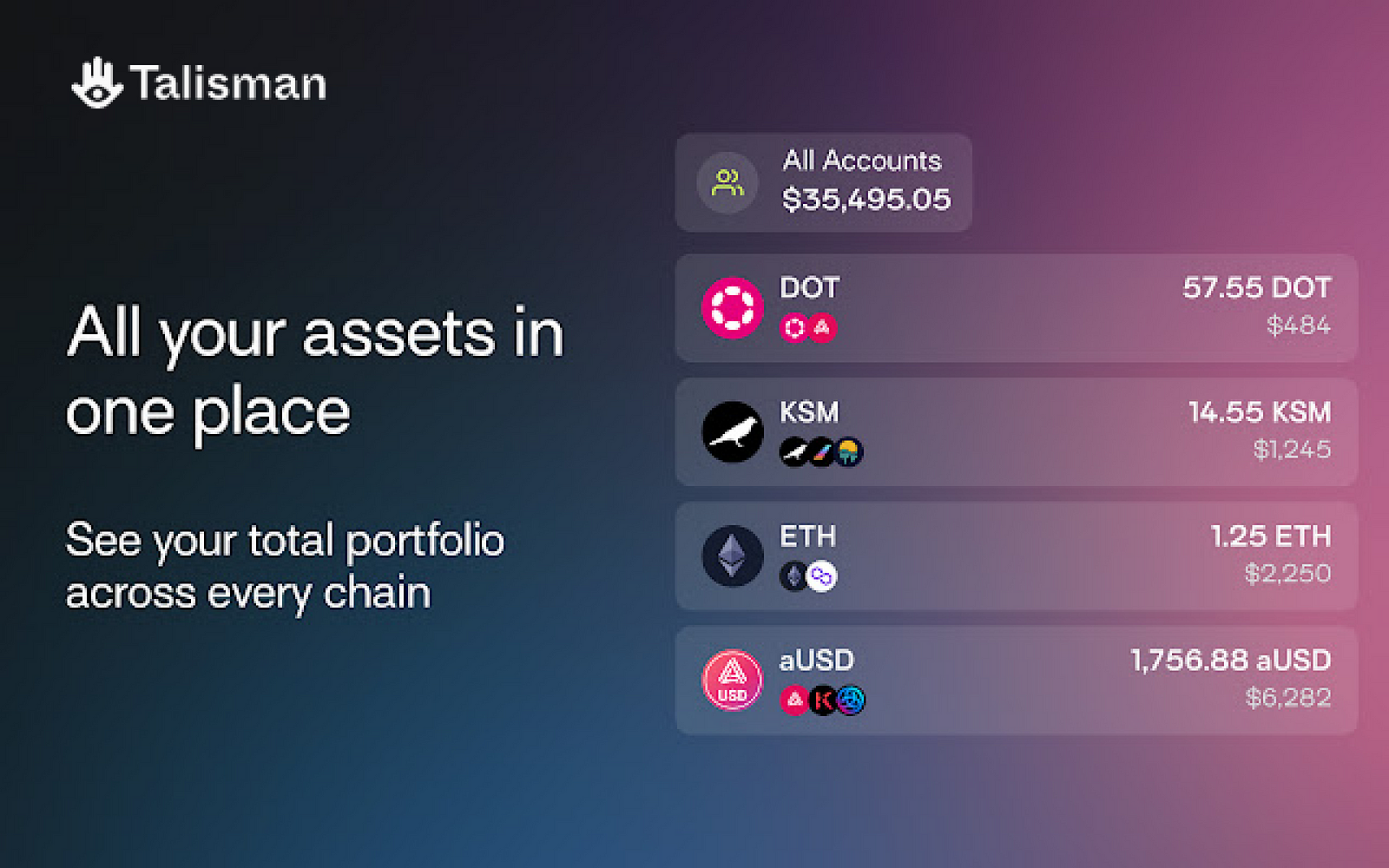

Talisman, a web3 wallet facilitating applications in Polkadot and Ethereum, relies on OnFinality to provide users with seamless access to wallet balances and portfolio information, empowering them to perform transactions without friction.

We also lower the barriers of entry to sharing node API for teams like Bifrost Finance, a web3 derivatives protocol offering decentralised cross-chain liquidity for staked assets, reducing infrastructure costs, and enabling scalability.

Ready to shape the future of DeFi together?

Sign up to the OnFinality app and receive 500,000 free daily responses instantly!

Build Smarter with OnFinality. 😎

About OnFinality

OnFinality is a blockchain infrastructure platform that saves web3 builders time and makes their lives easier. OnFinality delivers scalable API endpoints for the biggest blockchain networks and empowers developers to automatically test, deploy, scale and monitor their own blockchain nodes in minutes. To date, OnFinality has served over hundreds of billions of RPC requests across 80 networks including Avalanche, BNB Chain, Cosmos, Polkadot, Ethereum, and Polygon, and is continuously expanding these mission-critical services so developers can build the decentralised future, faster!